- #Alternative to newsflow how to#

- #Alternative to newsflow driver#

- #Alternative to newsflow professional#

Importantly, this is data which incorporates not only what companies say about themselves, but also what the rest of the world says about them. This AI-focused approach creates a master view of the ESG world based on ESG frameworks and knowledge, which in turn generates the most powerful, high value-add data for investors. ESG Analytics’ AI technology scans the world of unstructured media to understand data about companies, flags analysts may have missed, or issues which have happened more recently than the information analysts are relying upon.

AI derived solutions tick this box.ĮSG Analytics is one of a new breed of ESG data providers aiming to create the value the institutional investment world wants and needs.

#Alternative to newsflow professional#

In addition, the professional investment world is increasingly investing in an ecosystem of data solutions that talk to each other as seamlessly as possible.

#Alternative to newsflow driver#

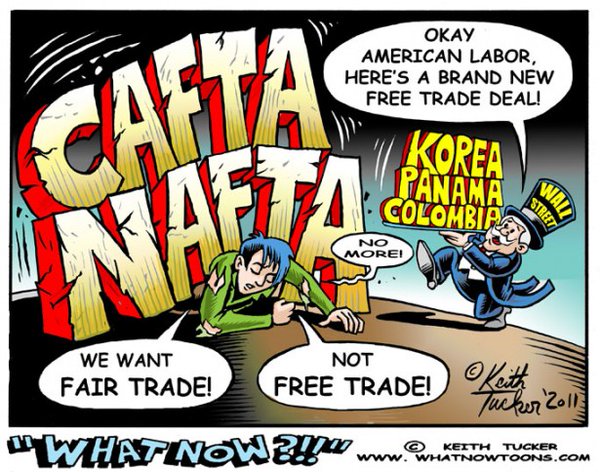

AI to play a key role in opening up the alternative data marketĪI is emerging as the key driver for the alternative ESG data market because it delivers what investors want and need: investment edge beyond what is available in the mainstream ESG data market. Once investors have addressed these issues, they're generally ready to integrate alternative ESG data as a core strategy. The key for investors is to invest in data management solutions which reinforce their strengths and identity. There are many options for investors to consider here, ranging from in-house to outsourced solutions, and there is growing demand for cloud based solutions.

To create the highest value with alternative ESG data, professional investors are generally using it in conjunction with traditional ESG data which is often far more subjective and opinion-based. Institutional investor spending on alternative data How professional investors are using alternative ESG data It’s clear why the growth in alternative data demand is escalating as shown below.

For example, investors can access alternative data which uses natural language processing of corporate news flow to provide more in-depth ESG insights than would be available to the broader market. Non traditional data = Alternative dataĪlternative data is data which is not available through traditional channels such as financial intermediaries, and includes information about companies and economies which helps investors improve their investment decisions. Most of these professional investors are exploring the value of ESG and sentiment analysis information due to their growing awareness of the value this data can deliver their clients.

#Alternative to newsflow how to#

Factset estimate that some 70% of global investment companies are in the early exploratory stages of understanding how to best utilize the growing opportunity set in alternative ESG data. The use of alternative ESG data by the institutional investment world is gathering momentum.

0 kommentar(er)

0 kommentar(er)